Form 5695 for solar hybrid air conditioners

Form 5695: Making Green for Going Green

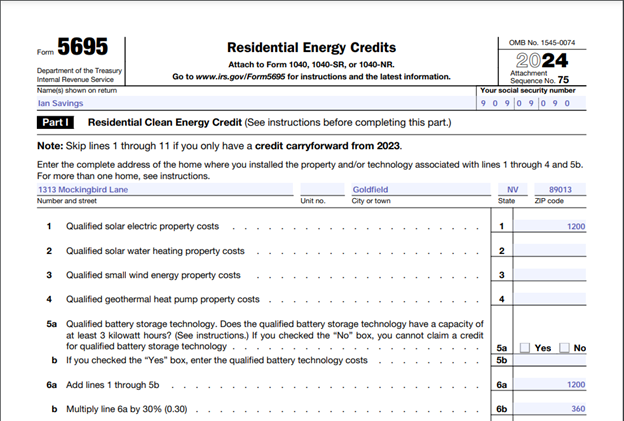

If you happened to have purchased an Airspool unit this year, and happen to pay federal income taxes, thanks on both accounts. As we round the corner into 2024, it’s not too early to think about Form 5695 used for the Inflation Reduction Act, where you can deduct your cost of the Airspool unit, the solar panels and mounting hardware, and the outside labor used for the installation of both, for a tax credit. (And note, I’m not an accountant and don’t even play one on TV, so use this for general information purposes only. Consult with your own accountant to make sure that this seems reasonable.) First, for the solar panels, add up your panel cost, mounting hardware, and third-party labor, and put it on Line 1 here…

Naturally, keep your receipts or credit card statements for all of this. With no other deductions, you’ll end up with 30% of Line 1 on Line 13. Next, do the residential Clean Energy Credit Limit Worksheet (I know, you really need to want it, right?) and enter that value on Line 14. Likely, with no other deductions, this is just the taxes you owe as indicated on Line 18 of your Form 1040. So, if you owe more than the $360 shown here, you’ll get to deduct the full $360. If you don’t, you’ll be able to make use of this tax credit next year (see Line 16).

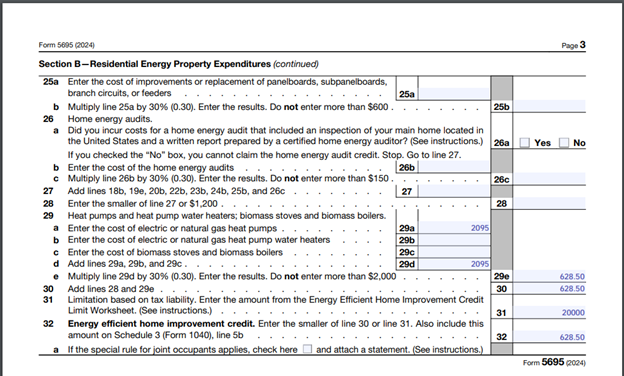

Next, enter the Airspool unit’s cost, the labor cost paid to a third party (if any), and the cost of any other implementation goodies onto Line 29a...

If your Energy Efficient Home Improvement Credit Limit Worksheet (yet another one beyond the scope to discuss here) shows a value larger than the 30% shown on line 29e, then that tax credit on Line 32 is all yours!

Here’s a link to the IRS instructions for Form 5695.